When you need to know how a business is performing, measuring cash flow can tell that tale. Experts advise startups to make decisions that prioritize being cash flow positive, even more than profitability, while established firms know that having a comfortable financial runway is all about cash on hand.

In other words, positive cash flow indicates that during a given time period, a business with liquidity has room to maneuver, enabling it to pay expenses and elicit positive interest from lenders thanks to its perceived ability to return money to shareholders.

Negative cash flow is a cash flow problem that demands immediate remediation if there isn’t sufficient working capital.

What Is Cash Flow?

Cash flow is a measure of a company’s net cash inflows and outflows. It’s reported in a cash flow statement, also known as a statement of cash flows. When you want to measure a business’s financial health, one of the first places to look is its cash flow.

CFOs and finance teams need to work on improving cash flow and take immediate action should it dip below what the business has defined as sufficient to optimize inflow and outflow.

Examining which areas in a business may affect cash flow with a cash flow analysis reveals a business’s cycle of cash inflows and outflows. This analysis lets business leaders and investors make the best possible financial decisions. The ultimate goal is to ensure adequate cash flow as well as provide a method for cash flow management.

Calculate Cash Flow

With good bookkeeping and accounting habits, it’s easy to generate a cash flow statement from your company’s accounting or ERP software. Behind the scenes, this is the formula used to calculate a company’s cash flow:

Cash Flow = Cash from Operating Activities + (-) Cash from Investing Activities + (-) Cash From Financing Activities

To summarize: Cash flow is the inflows and outflows from operating activities, investing activities and financing activities. It is possible for a company to be cash flow negative, which means more cash is going out the door than coming in, and still be profitable. That’s why it’s important to look beyond the income statement to get a full picture of a company’s finances.

Cash vs real cash

When looking at a company’s net cash flow, there are a few ways to break down the information. One is to look at nominal cash flow compared to real cash flow.

Nominal cash flow, the number most people think of when they visualize a company’s cash position, measures total cash in less total cash out.

Real cash flow is adjusted for inflation, which is a useful filter when comparing results over time.

Cash vs profit

The concept may be a little counterintuitive, but a company can earn a profit even with a negative cash flow and vice versa. Cash flow focuses solely on a change in cash over a specific period of time. Profitability considers other factors, like operating margin, assuming the company uses accrual basis accounting versus cash accounting. Those can make a company more or less profitable without having any impact on cash flow.

Cash flow vs income vs revenue

When calculating cash flow, revenue is one of the most important numbers. But revenue on its own doesn’t represent a company’s cash flow. Revenue represents the value of goods or services sold and delivered to customers. It may include sales that have been paid for and some with outstanding invoices.

Revenue factors into profitability, but it isn’t a part of cash flow until customers pay their bills. The income statement shows a business's total revenues and expenses and net income, or a company’s profits over a specific period of time.

Key Takeaways

- Cash flow is a measure of how much cash goes in and out of a company over a period of time.

- Cash flow statements are typically broken down into cash flow from operating activities, financing activities and investing activities.

- When examined alongside income statements and balance sheet details, cash flow provides a clear picture of a company’s financial health and ability to stay in business.

How Does Cash Flow Work?

Cash flow is a measure of a business’s total cash inflows less cash outflows. When a company’s liquid assets exceed its short-term liabilities, it is considered cash flow positive.

Negative cash flow occurs when a company has more money going out the door, such as to buy inventory, cover operating expenses or pay other bills, than it has coming in.

Cash flow is generally broken down into three categories: cash flow from operations, cash flow from investing and cash flow from financing. These represent cash paid or received from the company’s core business activities, the purchase or sale of securities, and raising money or paying down debt.

Why Does Cash Flow Matter?

Along with the income statement and balance sheet, a company’s cash flow statement is considered one of the three main financial reports that executives, finance teams, lenders and investors use to understand what’s happening under the hood of a business.

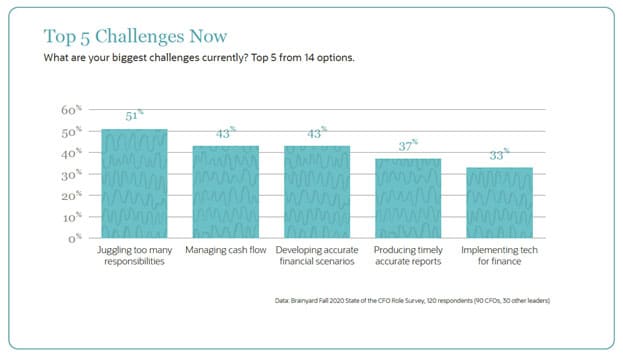

Its importance can’t be overstated. In Brainyard’s Fall 2020 State of the CFO Role Survey, three-quarters of CFO respondents said their jobs are either somewhat (58%) or much more difficult (17%) than before the pandemic. The main challenge given the ongoing pandemic is they’re juggling too many responsibilities (51%), but managing cash flow and the related developing accurate financial plans are tied for second, both cited by 43% as a top challenge now.

Cash vs accrual accounting

Accrual accounting and cash accounting are two accounting methods that indicate how cash moves within the financial statements within a company.

Accrual accounting is legally required for all public companies. Under this method revenue is recognized when it’s earned, not when payment is received. Expenses are recorded as incurred even if cash payments haven’t been made. Cash accounting records payments when cash is received. Expenses are also recorded whenever cash is paid.

Understanding these methods helps when looking at a company’s profit, shown as the net income on an income statement. Since net income is a company’s bottom line, in accrual accounting, net income may not mean that all payment has been received from customers.

What this means is a company may look profitable from an accounting standpoint, but could still struggle financially if customers pay late or don't pay at all. That’s why a cash flow statement is an important tool in assessing a company’s future financial health because even profitable companies can fail to manage cash flow effectively.

Types of Cash Flow

Depending on your goals, you may want to drill down into the details that comprise a cash flow statement to understand a specific aspect of the company’s cash performance. Here are some common metrics helpful in analyzing a company’s cash flows:

Cash From Operating Activities

Cash flow from operating activities measures how much money a company brings in and spends on its core business operations. It excludes financing and investment activities and can help you get an idea of how a company performs financially in the regular course of doing business.

Free Cash Flow to Equity (FCFE)

Free cash flow to equity (FCFE) measures how much cash is left over after operations, paying debts and investing in the company. This “leftover” cash is available to return to shareholders. To calculate FCFE, you’ll need the company’s net income, depreciation and amortization expense, non-cash expenses, capital expenditures, change in working capital and total debt. Free cash flow to equity can help you determine if a company can afford to pay a dividend or reinvest in growing the company. It’s commonly used by stock analysts to determine a company’s total value and estimated target share price.

Free Cash Flow to Firm (FCFF)

Free cash flow to firm (FCFF) is a measure of a company’s profitability. A company’s FCFF is calculated using all cash flow as it pertains to revenue, expenses, and all reinvested cash. What’s left over is the company’s FCFF. In other words, It represents cash that’s available to investors after a company pays all of its business costs, current and long-term investments.

The main difference between FCFF and FCFE is that FCFE deducts debt payments and interest, providing what some consider a more accurate indication of financial health. In other words, FCFF doesn't consider the impact of long-term debit on free cash flow.

FCFF is an important factor in many Wall Street stock analysts’ valuation processes. A positive FCFF value signals a company has enough cash remaining to cover costs and invest in the business. A negative result signals the company doesn’t have enough revenue to cover its costs.

Though not necessarily a cause for alarm, a deeper analysis may be necessary to assess why there isn’t enough revenue. In some cases it could be due to a business taking on outside investments, or a sign that it may have trouble staying in business in the long term.

Net Change in Cash

Net change in cash tallies all cash inflows and outflows over a period of time. The results indicate how much a company’s cash stores have increased or decreased in an accounting period. This higher-level number includes cash flows from operations, financing and investing.

How Is Cash Flow Used?

There are many ways a company’s leadership, lenders and investors may use cash flow information. Here’s a look at some of the most common:

- Management decisions: Successful managers and executives typically pay close attention to cash flow. Looking at past cash flow statements can help establish trends and identify opportunities for improvement. Cash flow forecasts are also useful when making decisions about borrowing and capital allocation. For example, the projected cash flows for an expansion project may be used to calculate the project’s internal rate of return (IRR), which is used to decide if an investment makes financial sense.

- Lender underwriting: When a business wants to borrow money, the lender will review its credit history and finances, including cash flows. This can help the lender determine if the business can pay back a loan as agreed.

- Investment analysis: Investors use cash flow to help determine a company’s value. Cash flow details may flow into a discounted cash flow (DCF) model or multiple analysis like the price-to-cash flow ratio. These tools help investors determine a stock’s intrinsic value, which is used in stock buying decisions.

Managing Cash Flow

Financial managers can’t just focus on operations and let cash flow sort itself out. It’s essential to take an active role in managing cash flow, whether the business earns $50,000 per year or $5 billion.

Cash flow management strategies can help a business qualify for more favorable financing terms and improve the company’s valuation. Some larger businesses employ teams of financial analysts and accountants to optimize cash flow. At smaller businesses, that responsibility may fall to the owner, controller or chief financial officer.

How to Improve Cash Flow

Improving cash flow isn’t always easy, but managers can use a combination of strategies to move the needle in the right direction. Here are some common cash flow improvement tactics to consider:

- Negotiate a discount with vendors for faster payment: Early payment discounts reduces the amount of cash leaving the business.

- Automate AP and AR: Automated accounts payable and accounts receivable systems can help bookkeepers better track incoming and outgoing payments. Better payment management can help a business take advantage of optimal payment terms and avoid late payments from customers.

- Embrace just-in-time inventory management: Inventory sitting in a warehouse or on retail shelf ties up cash. Keeping less inventory can boost cash flow. “Just-in-time” is an inventory management system where a business tries to synchronize inventory with forecast demand, which improves cash flow by reducing inventory carrying costs.

- Lease instead of buy: Property and equipment purchases often require large capital expenditures. With a lease, a business offloads the up-front cash expenditure (and depreciation expense) to a leasing company. Leasing works like a loan in many ways, so it’s important to look at all of the costs involved before adopting a leasing strategy.

- Improved workforce management: Most companies prefer to avoid layoffs, and more efficient workforce practices and a human resources management system can conserve cash and help better align HR spending with business needs.

Every business is unique, so what works for one company may not work for another. If you are working to improve your company’s cash flow, look at your accounting statements and closely examine critical KPIs, like customer acquisition cost, gross margin and burn rate, that may indicate ways to work more efficiently.

Cash Flow Analysis

Stock analysts and accounting teams may use cash flow details to determine if a stock is well-priced and to make financial decisions. Here are some common analysis ratios and measures that may be useful to know:

Debt Service Coverage Ratio

The debt service coverage ratio measures a business’s ability to pay its outstanding debt obligations. If debt servicing payments exceed cash flow from operations, a company may struggle to keep up with payments.

Free Cash Flow

Free cash flow is a measure of how much cash a company generates from operations. Free cash flow is cash available for debt payments, dividends or to reinvest in the company for growth. A high free cash flow level means a company is likely in a healthy financial position for ongoing operations. Negative free cash flows could indicate a problem before it shows up on the income statement.

Unlevered Free Cash Flow

Unlevered free cash flow, also known as free cash flow to firm (FCFF), calculates a company’s cash flow before interest payments. This is a useful data point as it shows how much uncommitted cash a company has available for operations.

Positive Cash flow

Positive cash flow is an indication of a business’ health. When a company brings in more cash than it spends consistently over time, it usually indicates a healthy business that can continue indefinitely. But cash flow that is higher than average may indicate issues, such as limited reinvestment to foster company growth.

Negative Cash flow

Negative cash flow means that a company had more cash go out over a given period than came in. That isn’t always a concern if it only happens for one or two quarters, or in the case of heavily seasonal businesses. It could also indicate that a large investment or expansion project is underway. But negative cash flow for a long period of time can signal serious problems, perhaps even the potential for a future bankruptcy.

Cash Flow Forecasting

Business leaders often create cash flow forecasts to inform stakeholders of projected future cash position changes. This information can help the business make decisions around borrowing, investments, employee bonuses and shareholder dividends. For investment analysis, cash flow forecasts generally plug into a discounted cash flow model to determine a company’s value and target stock price.

What Is a Cash Flow Statement?

A cash flow statement is a summary of a business’ cash flow details. It’s typically divided up into sections for cash flow from operating, investing and financing activities.

Large companies generally create a consolidated cash flow statement that includes the cash flow details from all subsidiaries and holdings that require disclosure.

Small businesses can generate their own cash flow statements by working with their accountant or using bookkeeping or accounting software. For example, Oracle NetSuite includes reporting tools that allow users to easily generate a cash flow statement.

Using a Cash Flow Statement

Cash flow statements give managers, investors, lenders and analysts critical details about a company’s finances and overall health. Whether you’re a business manager or an investor, it’s wise to pay close attention to cash flows.

To make life simpler, accounting software can automate functions, make workflows and processes more efficient, reduce errors and lower staff cost, and the ability to generate statements is included in the core functionality of most accounting software.

#1 Cloud

Accounting

Software